UPDATE SUMMER 2020:

I do not recommend traveling during a global pandemic, but if there is a legitimate need to travel, be aware of travel insurance requirements.

Most travel insurance policies and protection plans explicitly exclude coverage for pandemics and will not cover losses related to COVID-19. Don’t purchase a policy to cover travel issues related to COVID-19 until you read through the coverage exclusions.

Additionally, several countries are now requiring visitors to have international health insurance and must present proof of coverage before they’re allowed entry. Or, you may be required to purchase a government policy whether you have your own coverage or not.

The situation and requirements change quickly, so be sure to check with the country or countries you’re visiting to know what’s required.

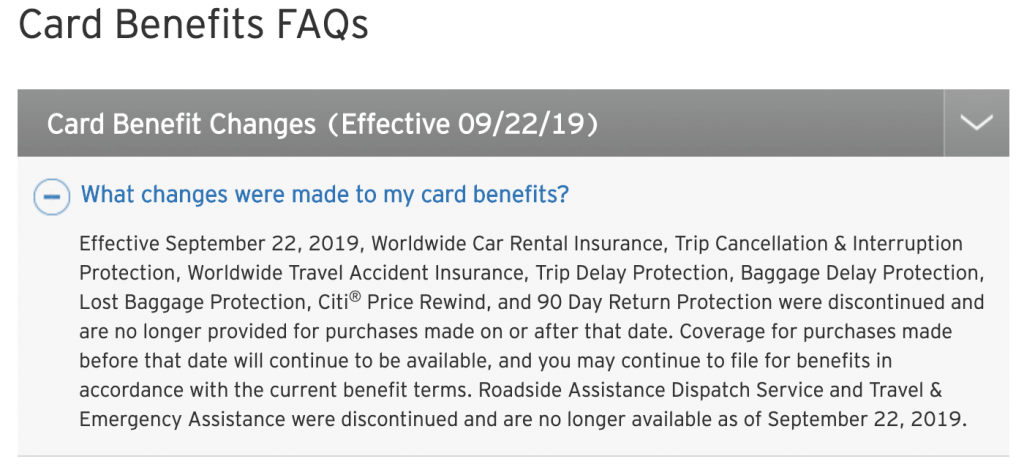

With COVID-19 disrupting so many travel plans, folks are paying more attention to travel insurance and protection, but it’s something many travelers have overlooked until now. In particular, seasoned travelers may get complacent with what’s been working for them and skip analyzing the coverage they’ve always used. Of the numerous options available, many travelers depend on the travel protection offered by credit cards, but have you reviewed your credit card’s travel protection policy lately? While you have some downtime from travel, take a close look, and see what your card issuer changed or removed from your card’s protections and benefits. For example, Citi, with its popular AAdvantage card that accrues American Airlines miles, has removed all travel protections from their coverage. Here’s a screenshot from their website when logged into an account:

Not having that travel protection is terrible news for those who relied on these cards for our primary travel protections. Without that coverage, we’ll need new protections, and there are a couple of options.

Travel Protection Options

1) Find a credit card that offers the travel insurance and protections we need.

2) Purchase third-party travel insurance for our trips.

I know that not everyone needs or wants a new credit card, and some may want a card with perks other than travel points. But if your credit card no longer offers the travel protection it once did, and you want a new card for protections and to accrue travel points, start your research at Chase travel credit cards with either the Chase Sapphire Preferred or Chase Sapphire Reserve.

The Chase Sapphire Reserve comes with a hefty annual fee of $550, at the time of this writing, but includes some premium travel protections and benefits that the Sapphire Preferred doesn’t have. With a value of over $400, one significant perk is complimentary lounge access at Priority Pass airport lounges. Before you say, “Hell, yes! Sign me up!”, check to make sure there’s a Priority Pass lounge at your preferred airports.

The Chase Sapphire cards are currently the best overall travel credit cards. Still, there is a large selection of credit cards available from many card issuers, and a different card might be better suited for you. I do recommend that you stick with Mastercard or Visa for better acceptance worldwide. AMEX and, especially, Discover are not accepted everywhere. And be sure you find a card with No Foreign Transaction Fees to use when traveling abroad. It will save you a ton of money. Again, before you sign up for any credit card, check those travel protections.

If you’re not interested in using a credit card for your travel protection and insurance, your next option is purchasing travel insurance through a third party.

If you travel often, take a look at an annual policy. Like the credit card coverage that goes with you on every trip (as long as you use your card to purchase your travel!), an annual policy will cover you on your trips for the year. Otherwise, you’ll need to buy a travel insurance policy every time you travel. Please, read through the coverage to know what is and is not covered. For example, Allianz consistently ranks among the best travel insurance providers, but there is some fine print:

It can get a bit tricky and confusing, so if you have questions, contact the insurance provider. There are usually limits on the number of days allowed for each trip with this type of annual travel insurance. If you plan on staying in one place for a while (I’m talking about months at a time), you’ll need to know the health insurance requirements for your particular long-term visa, and that’s a far more complicated topic.

Now, let’s make a quick comparison between the Chase Sapphire Reserve credit card and Allianz’s annual travel insurance policy. (Allianz also offers several single trip plans.)

| BENEFIT / COVERAGE | CHASE SAPPHIRE RESERVE* | ALLIANZ ANNUAL TRAVEL INSURANCE |

| Trip Cancellation/Interruption | up to $10,000 per person, $20,000 per trip | up to $10,000 (other limits are available) |

| Auto Rental Collision Damage Waiver | up to $75,000 | up to $45,000 Not included in annual plan for residents of KS, TX or NY residents |

| Lost Luggage Reimbursement | up to $3,000 | up to $2,000 |

| Trip Delay Reimbursement | up to $500 per ticket | up to $1,500 |

| Emergency Evacuation & Transportation | up to $100,000 | up to $500,000 |

| Emergency Medical | N/A | up to $50,000 |

| PREMIUM BENEFITS: | ||

| $300 Annual Travel Credit | up to $300 in statement credits | N/A |

| Global Entry or TSA Pre✓® Fee Credit | Statement credit of up to $100 every 4 years | N/A |

| Complimentary Airport Lounge Access | Priority Pass™ Select with 1,000+ VIP lounges | N/A |

| The Luxury Hotel & Resort CollectionSM | Complimentary room upgrades, early check-in, and late check-out | N/A |

| Annual Cost | $550 + $75 per authorized user |

$1000 est. varies by state residence and final coverage choices |

Note: Allianz offers many different insurance options. I used a plan with Trip Cancellation coverage comparable to the Chase Sapphire Reserve for this comparison. Also, there are more protections and benefits available, but I wanted to keep things simple.

Your current medical insurance may offer coverage when traveling internationally, but most do not, and Medicare does not have coverage outside of the US. So, if neither your regular health insurance nor your credit card offers medical coverage, you may want to purchase a supplemental policy for your trip. Again, Allianz has an option for that. You can take a look at their One Trip Emergency Medical plan for very reasonable rates. I may have mentioned this already, but read the policy to know what is and isn’t covered and any restrictions that apply, and contact the insurance company with any questions you have.

It’s a good idea to go over your credit card policy every few months to make sure what you signed up for is still included in your benefits and protections. And even when you’re choosing the same insurance plan that you’ve used before, be sure to read over the policy because coverage may have changed.

Important note:

Additionally, several countries are now requiring visitors to have international health insurance and must present proof of coverage before they’re allowed entry. Or, you may be required to purchase a government policy whether you have your own coverage or not.

The situation and requirements change quickly, so be sure to check with the country or countries you’re visiting to know what’s required.

✵

Time to Review

This is a personal analysis. The prices and protection limits shown here were based on available information at the time of writing (Updated July 2020). Coverage benefits and limits change, so visit the credit card and insurance websites for up-to-date information.